Hongjing Electronics (Shenzhen) Co., Ltd.

电子产品的隐形支柱及其变革性未来

From smartphones and autonomous vehicles to 5G base stations and spacecraft, one technology silently underpins the functionality of modern electronics—the Printed Circuit Board (PCB). Serving as the “skeleton” and “neural network” of electronic devices, the PCB industry directly influences the pulse of global technological advancement. This article explores the current state of the PCB sector, its technological breakthroughs, and emerging opportunities.

I. PCBs: The Infrastructure of the Digital World

PCBs interconnect electronic components through copper traces on insulating substrates, with their design and manufacturing quality defining the performance limits of end products. Ranging from simple single-layer boards to complex 20-layer high-density interconnects (HDIs), PCBs are ubiquitous in:

- Consumer Electronics (smartphones, laptops)

- Telecommunications (5G base stations, routers)

- Automotive Electronics (ADAS, battery management systems)

- Industrial & Medical Systems (robotics, imaging devices)

- Aerospace (satellites, navigation systems)

According to Prismark, the global PCB market surpassed $80 billion in 2023, with China accounting for over 50% of production, cementing its role as the industry’s manufacturing hub.

II. Innovation: Fueling the Next Wave of PCB Evolution

To meet demands for smaller, faster, and more powerful electronics, the industry is advancing through four key technological frontiers:

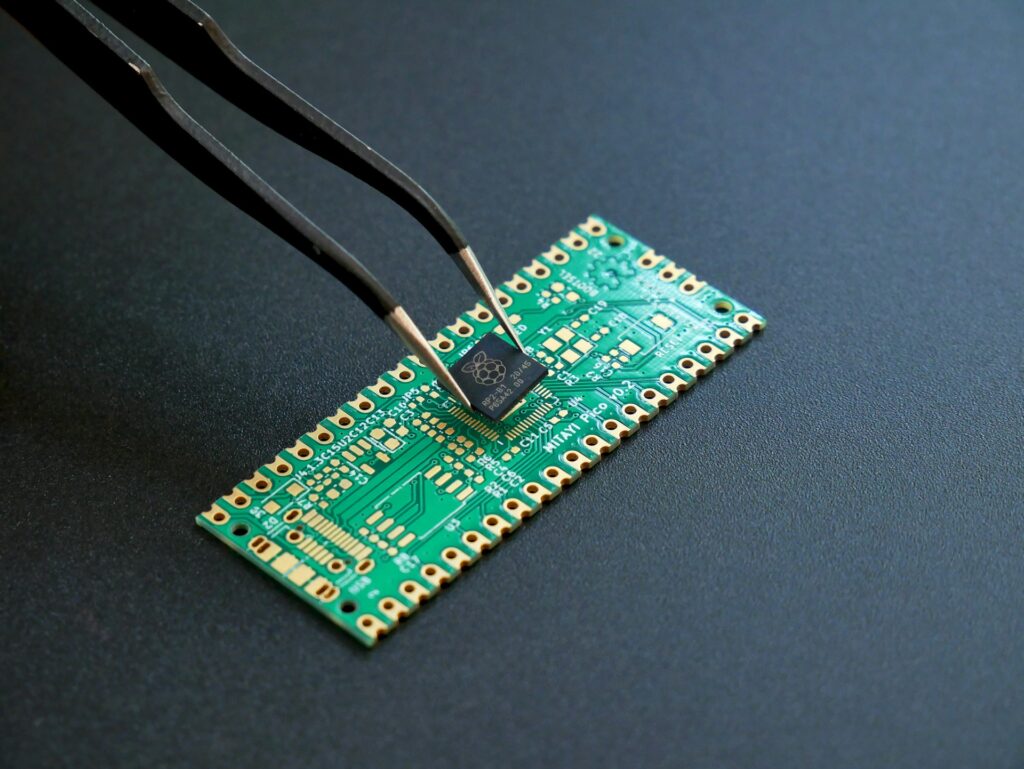

- High-Density Interconnect (HDI) and Substrate-Like PCBs (SLP)

- HDI enables multilayer precision routing via microvias and ultra-fine traces, becoming critical for 5G smartphones and wearables. Apple’s iPhones now use SLPs with trace widths/spacing below 30μm.

- Flexible PCBs (FPCs) and Rigid-Flex Solutions

- Foldable devices (e.g., Samsung Galaxy Fold) and automotive sensors rely on FPCs’ bendable properties, driving explosive demand.

- Material Breakthroughs

- High-frequency laminates (e.g., Rogers’ PTFE) support 5G mmWave applications.

- Ceramic and metal-core PCBs address thermal challenges in high-power LEDs and EVs.

- Smart Manufacturing

- Laser drilling, automated optical inspection (AOI), and AI-driven factories boost yields, with top-tier manufacturers achieving over 80% automation.

III. Growth Opportunities: Three Explosive Markets

- 5G and AIoT Infrastructure

- 5G base stations require 3x more PCBs than 4G, with high-frequency materials.

- Edge computing and AI servers drive demand for advanced, high-layer-count PCBs.

- The Electric Vehicle (EV) Revolution

- EVs demand high-reliability PCBs for battery management, ADAS, and infotainment, increasing PCB value per vehicle by 5x+ compared to traditional cars.

- Localization and Supply Chain Reshaping

- Companies like Huawei and Xiaomi prioritize domestic PCB suppliers. Chinese leaders like Shennan Circuits and Wus Circuit now compete globally in high-end markets.

IV. Challenges and Trends: Sustainability and Convergence

Despite growth, the industry faces hurdles:

- Environmental Compliance: Stricter regulations on etching wastewater, copper recovery, and halogen-free materials.

- Cost vs. Performance: Reliance on imported high-end materials (e.g., IC substrates) remains a bottleneck.

- Convergence with Semiconductors: Blurring lines between PCB fabrication and advanced packaging (e.g., SiP, chiplets).

Future trends will focus on:

- Green Manufacturing: Zero-discharge wastewater systems and biodegradable substrates.

- Integration and Modularization: PCBs evolving into multifunctional modules, merging with semiconductor packaging.

V. Conclusion: The Silent Engine of Innovation

Though rarely in the spotlight, PCBs are indispensable to the digital age. As AI, 6G, and quantum computing emerge, PCB innovation will continue to break boundaries. For Chinese manufacturers, mastering high-value segments—like IC substrates and advanced materials—will determine their leadership in the next decade.

Those who unlock the DNA of PCB evolution will dominate the next era of electronics.

Sources: Prismark, CPCA, Corporate Filings

Food for Thought:

- As PCB trace widths approach physical limits, will 3D stacking redefine the industry?

- Can bio-based PCB materials transition from labs to mass production under net-zero goals?

Share your insights in the comments!